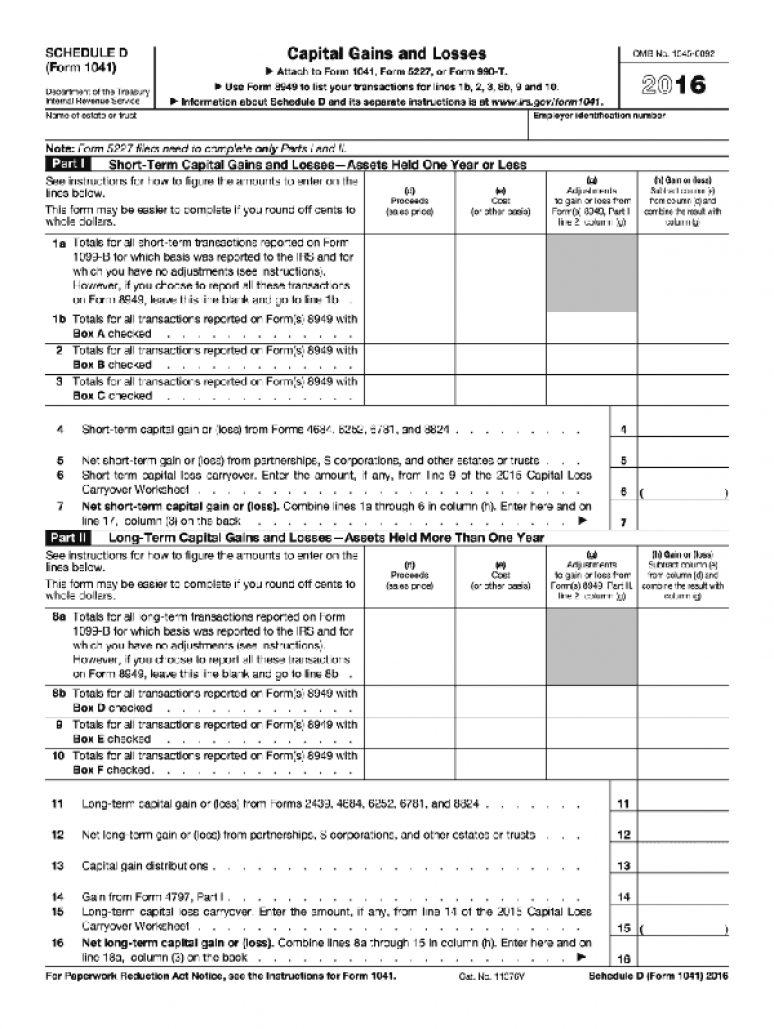

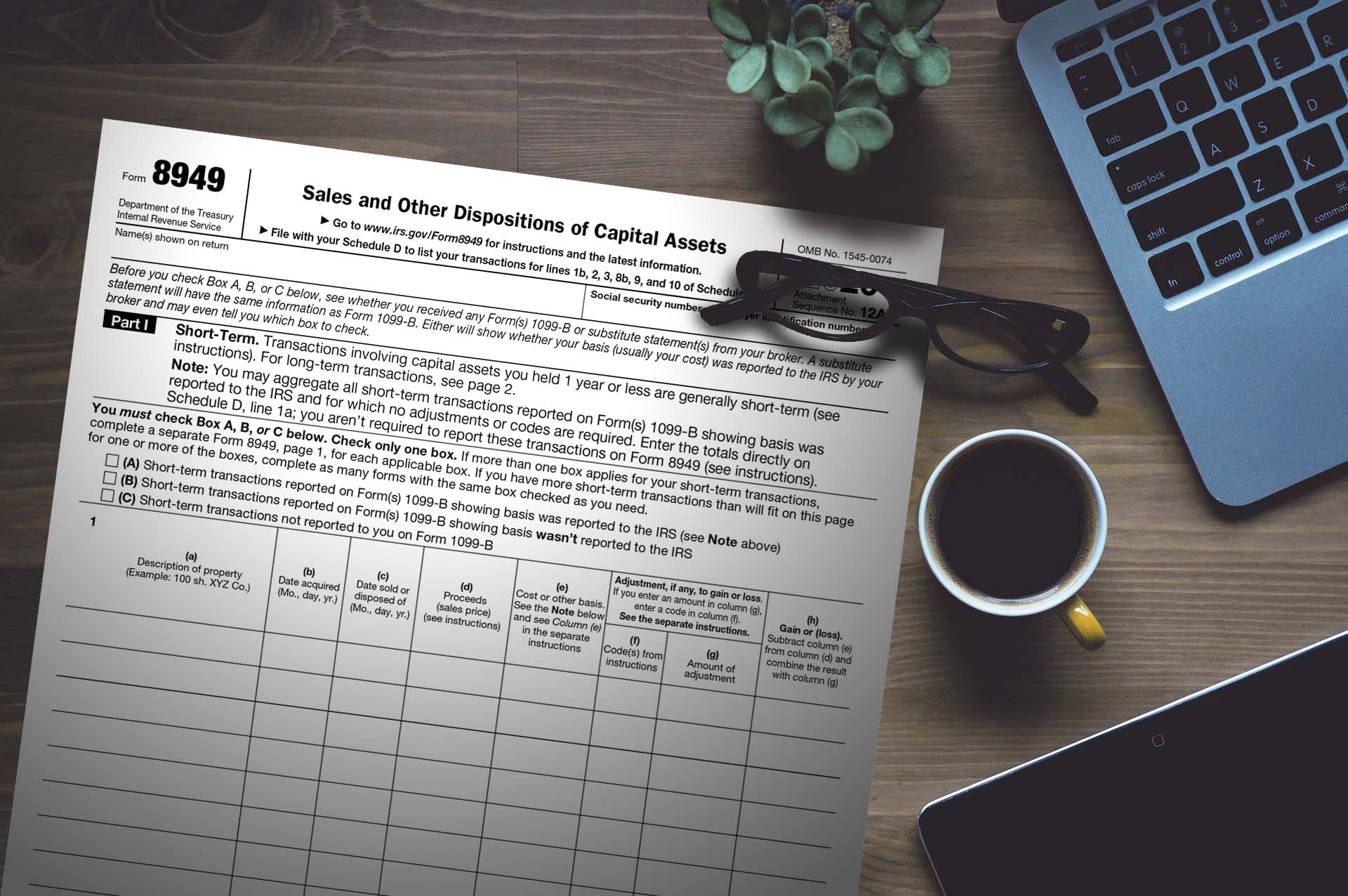

Irs Schedule D 2024 Form – The Schedule D tax worksheet helps investors calculate certain kinds of investment income for the Schedule D form, including depreciated real estate. Schedule D Capital Assets The Schedule D form . The IRS again delays law that would have required Ticketmaster, Venmo, and others to issue 1099-Ks to those with more than $600 in revenue in 2023. .

Irs Schedule D 2024 Form

Source : www.investopedia.com

Capital Gains and Losses, IRS Tax Form Schedule D 2016 (Package of

Source : bookstore.gpo.gov

FinCEN Compliance – Summer 2023 BE 12 Reporting & Beneficial

Source : www.btcpa.net

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

IRS FORM 8949 & SCHEDULE D TradeLog

Source : tradelog.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Tax cap at two percent for 2024 | The River Reporter

Source : riverreporter.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

IRS moves forward with free e filing system in pilot program to

Source : www.fox13memphis.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Irs Schedule D 2024 Form When Would I Have to Fill Out a Schedule D IRS Form?: Once again, the IRS has delayed implementation of new rules that would have resulted in a Form 1099-K being sent to more than 30 million Americans who received payments this year through PayPal, Venmo . That information is recorded to determine the correct tax treatment for the net results. Schedule D of Form 1040 is used to report most capital gain (or loss) transactions. But before you can .

:max_bytes(150000):strip_icc()/IRSScheduleD-c7be5030d7394773ad2d905654e9e902.png)